What is Impermanent Loss?

Buy as little as $30 worth to get started

Related guides

Start from here →

What is DeFi?

Learn what makes decentralized finance (DeFi) apps work and how they compare to traditional financial products.

Read this article →

What is DeFi?

Learn what makes decentralized finance (DeFi) apps work and how they compare to traditional financial products.

What is a DEX?

A decentralized exchange (DEX) is a type of exchange that specializes in peer-to-peer transactions of cryptocurrencies and digital assets. Unlike centralized exchanges (CEXs), DEXs do not require a trusted third party, or intermediary, to facilitate the exchange of cryptoassets.

Read this article →

What is a DEX?

A decentralized exchange (DEX) is a type of exchange that specializes in peer-to-peer transactions of cryptocurrencies and digital assets. Unlike centralized exchanges (CEXs), DEXs do not require a trusted third party, or intermediary, to facilitate the exchange of cryptoassets.

What are liquidity pools?

A liquidity pool is a collection of cryptoassets that help facilitate more efficient financial transactions such as swapping, lending, and earning yield.

Read this article →

What are liquidity pools?

A liquidity pool is a collection of cryptoassets that help facilitate more efficient financial transactions such as swapping, lending, and earning yield.

What is yield farming?

Learn what yield farming is, how it works, different types, and more.

Read this article →

What is yield farming?

Learn what yield farming is, how it works, different types, and more.

What is liquidity?

Liquidity has several slightly different but interrelated meanings. For the purposes of crypto, liquidity most often refers to financial liquidity and market liquidity.

Read this article →

What is liquidity?

Liquidity has several slightly different but interrelated meanings. For the purposes of crypto, liquidity most often refers to financial liquidity and market liquidity.

What is volatility?

Discover the role of volatility in crypto markets, how it’s measured, and more.

Read this article →

What is volatility?

Discover the role of volatility in crypto markets, how it’s measured, and more.

Bitcoin.com in your inbox

A weekly rundown of the news that matters, plus educational resources and updates on products & services that support economic freedom

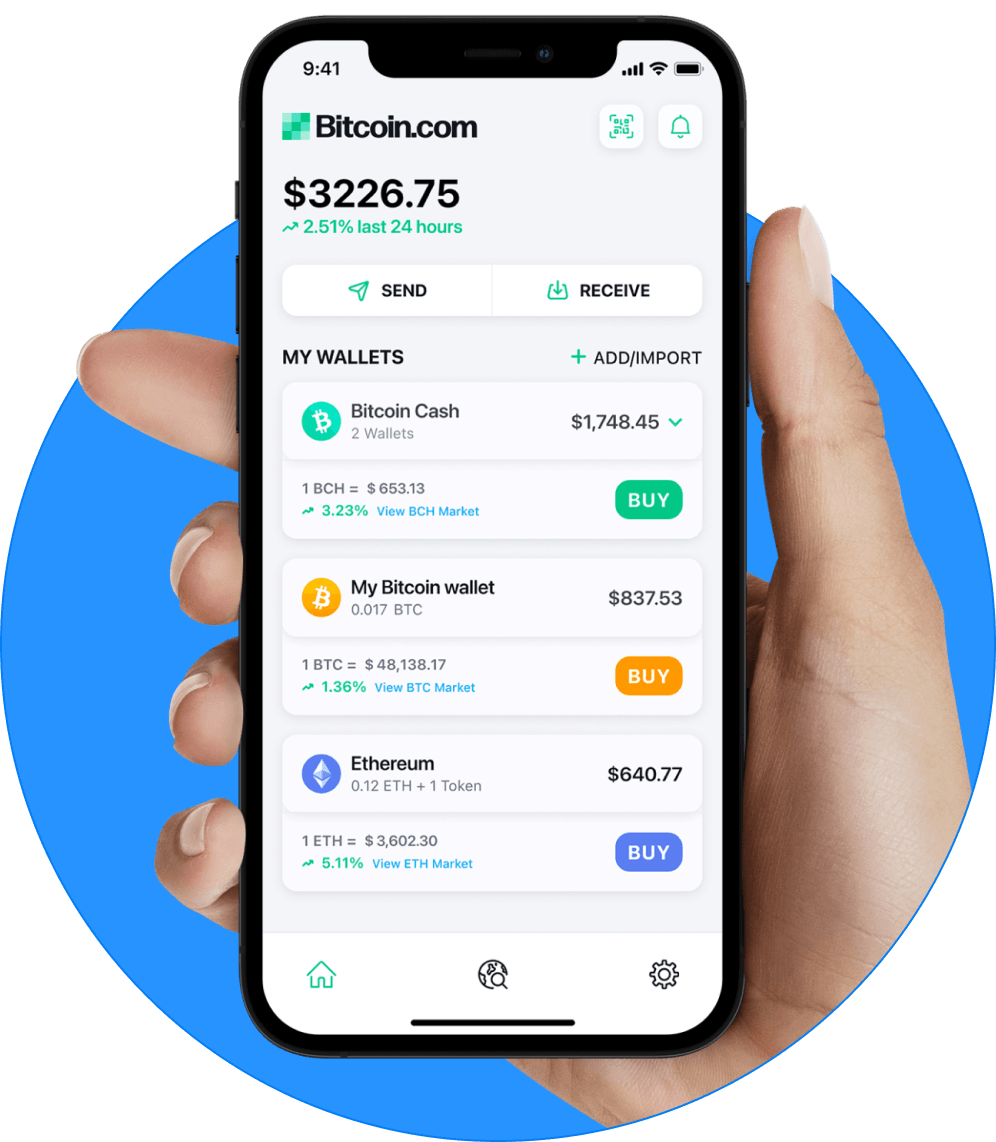

Start investing safely with the Bitcoin.com Wallet

Everything you need to buy, sell, trade, and invest your Bitcoin and cryptocurrency securely