What is YFI?

Buy as little as $30 worth to get started

Related guides

Start from here →

What is DeFi?

Learn what makes decentralized finance (DeFi) apps work and how they compare to traditional financial products.

Read this article →

What is DeFi?

Learn what makes decentralized finance (DeFi) apps work and how they compare to traditional financial products.

What are ERC-20 tokens?

Learn the basics of the Ethereum token standard, what ERC-20 tokens are used for, and how they work.

Read this article →

What are ERC-20 tokens?

Learn the basics of the Ethereum token standard, what ERC-20 tokens are used for, and how they work.

What's a smart contract?

Get the basics on the "software" that runs on decentralized networks.

Read this article →

What's a smart contract?

Get the basics on the "software" that runs on decentralized networks.

What is APY?

APY stands for annual percentage yield. It is a way to calculate interest earned on an investment that includes the effects of compound interest.

Read this article →

What is APY?

APY stands for annual percentage yield. It is a way to calculate interest earned on an investment that includes the effects of compound interest.

Bitcoin.com in your inbox

A weekly rundown of the news that matters, plus educational resources and updates on products & services that support economic freedom

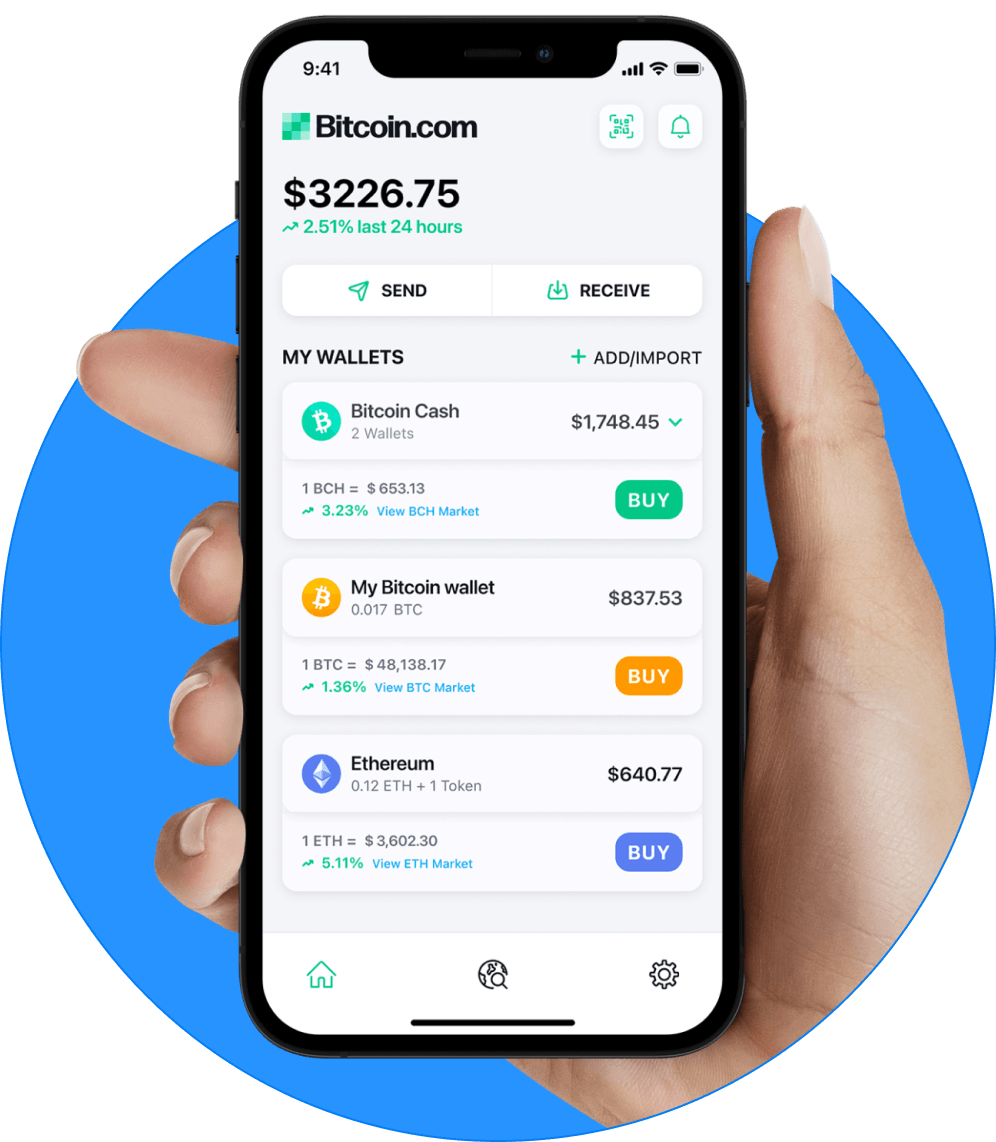

Start investing safely with the Bitcoin.com Wallet

Everything you need to buy, sell, trade, and invest your Bitcoin and cryptocurrency securely